Top corporate venture capital firms investing in cybersecurity

A look into 29 active portfolios of corporate venture capital firms

Welcome to Venture in Security! Before we begin, do me a favor and make sure you hit the “Subscribe” button. Subscriptions let me know that you care and keep me motivated to write more. Thanks folks!

Cybersecurity is the market to get into in 2022

As discussed before, the ever-growing number and increasing complexity of cyber threats, ranging from phishing and malware to ransomware and zero-day exploits, make cybersecurity a lucrative field for startup growth.

Industry insiders predict that cybersecurity will be a growth market for the foreseeable future. All this combined with the exponential growth of investments into cyber, make this field a great choice for CVCs looking to bet on the industries poised to evolve and bring lucrative returns.

Key highlights:

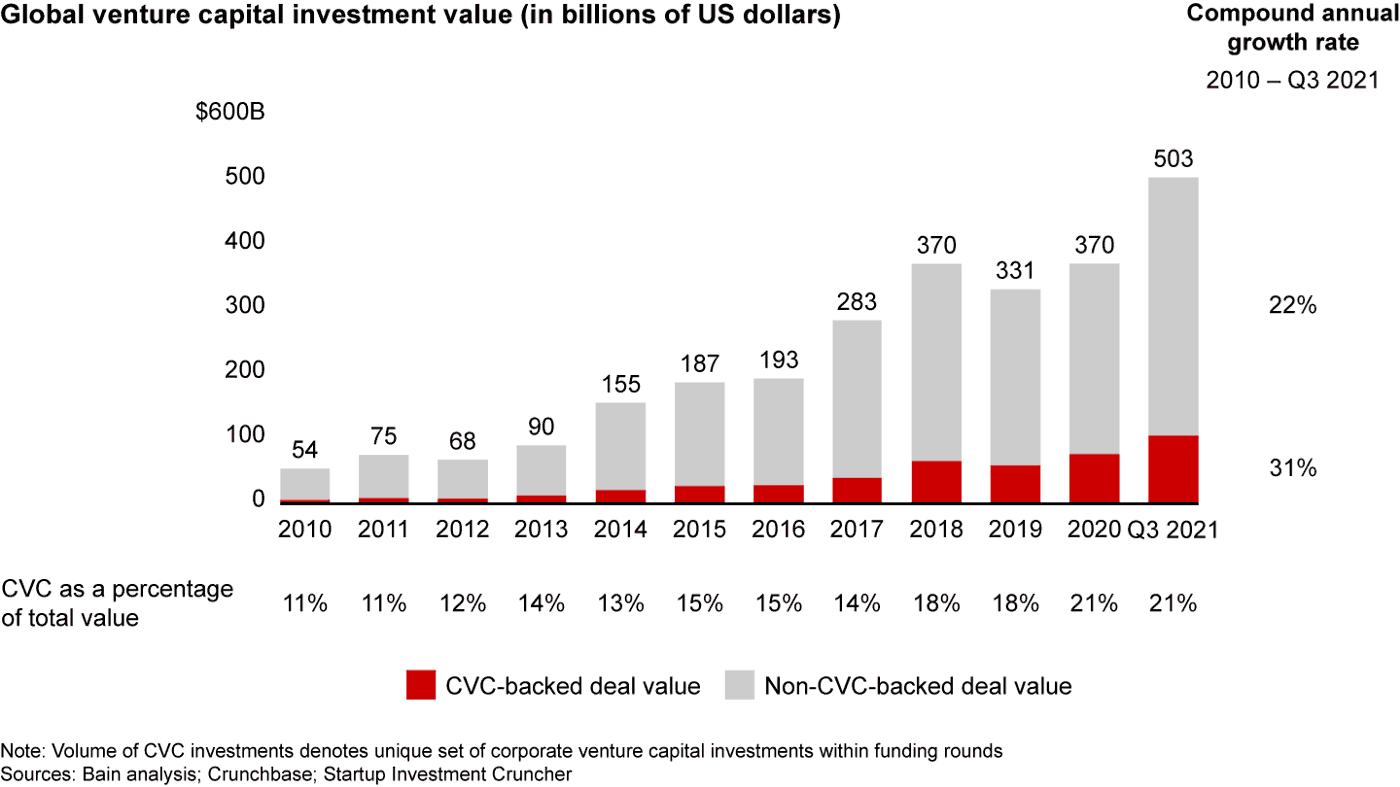

📈 CVC now accounts for 21% of the overall venture market

💡 Getting funded by the CVC can help startups access established channels for customer acquisition and leverage the brand recognition and the resources of the enterprise

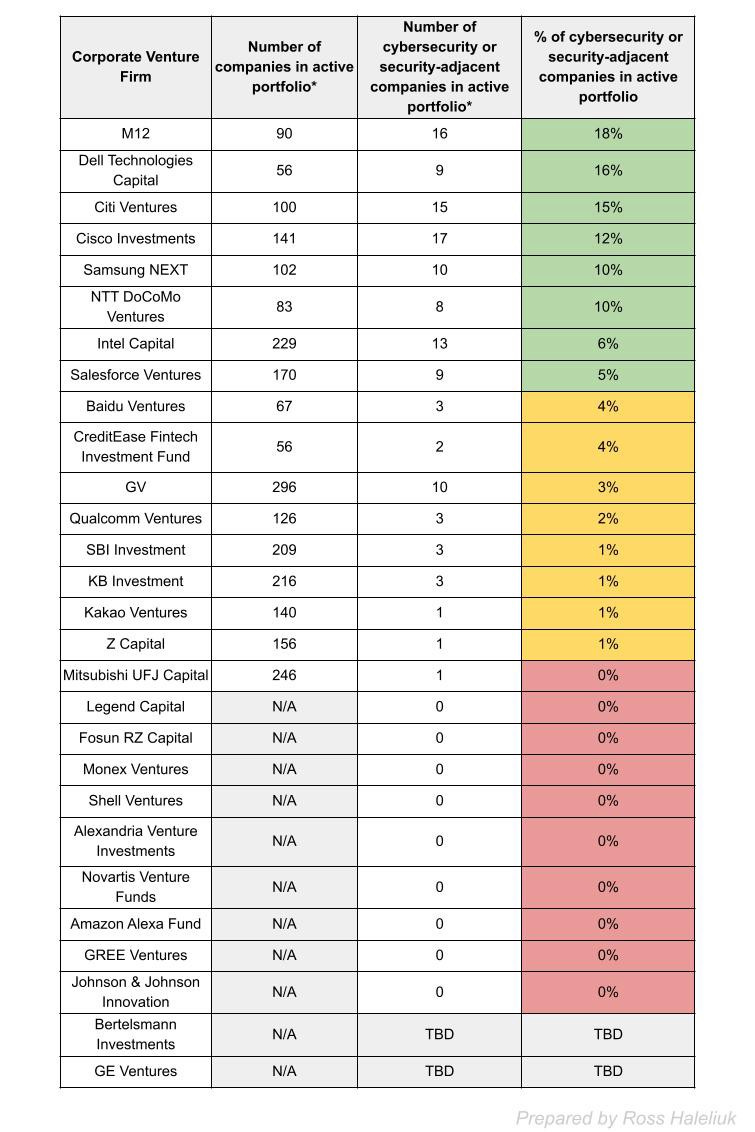

🏅 Of the 29 CVCs reviewed, M12 has the highest proportion of their portfolio companies in cybersecurity (18%) while Cisco Investments — the highest number (17)

💎 Some startups choose to receive funding from multiple corporate venture funds

Corporate venture capital is growing

Corporate venture capital (CVC) now accounts for 21% of the overall venture market, up from 11% ten years ago, according to Bain’s 2022 M&A Report.

It’s not just the CVC-backed deal value that is increasing, but also the number of corporations choosing to invest in startups. Only in the past few months, we have seen a launch of Twilio Ventures (CVC arm of Twilio), Emerson Ventures (CVC arm of Emerson), Future of Professionals (Thomson Reuters CVC fund), and VMS Ventures (CVC arm of Constellation Software), among others. Established CVCs such as M Ventures (CVC arm of Merck KGa) are increasing their financial commitments.

With so much happening in the corporate venture capital space, I thought it would be valuable to create a list of CVCs that support cybersecurity space.

Before we do it, let’s review the reasons why startup founders may choose to seek investment from corporate venture funds.

Reasons to seek funding from CVCs

There are several potential advantages that CVCs can provide, including four outlined below.

Leverage established channels for customer acquisition

Getting the product in the hands of new users is never easy. Large-scale and global corporate venture capital firms can help shortcut a lot of the efforts by connecting the startup with the parent firm, enabling it to leverage the resources and the established customer base of the enterprise, or even making introductions to the company distribution partners internationally.

Get access to the advisors & champions

Large-scale CVCs often have access to the highest caliber talent pool of leaders who previously grew startups and have broad experiences in go-to-market strategy, sales, technology, finance, and other areas of the business. Getting access to this talent pool and potentially being able to engage them as advisors can have a lot of value to startups often strapped for resources.

Leverage brand & resources

For startups with a small customer base and limited brand recognition, it can be hard to negotiate good terms with banks, suppliers, and other utility providers critical for growing a new company. Having the ability to tap into the existing people & legal relationships of the CVCs and their parent companies can save a lot of time, money, and effort when negotiating contracts and establishing new partnerships.

Prepare for the next capital raise

Investors at later rounds want startups to show their customer acquisition and the associated with it revenue track records. Partnering with CVCs and tapping into the existing enterprise distribution channels may help startups to accelerate the short-term revenue growth which, in turn, enables future capital raises.

Founders must do their own research and consider all factors before deciding if investment from CVCs is the best option for their startup.

Establishing corporate financial venture capital arms is a smart move

As industry experts note, in today’s rapidly changing environment, “not participating in CVC programs carries a far greater long-term risk to an enterprise than participating in CVC”.

“The nice thing about corporate venture capital is that it lets you grow your commitment as the experiments pan out. ”

— Jim Adler, Toyota Motor

EY report lists five ways in which enterprises can gain critical advantages from establishing a well-designed CVC program:

Corporate venture capital firms investing in cybersecurity

To find out what CVCs support the most cybersecurity startups, I have looked at current portfolios of the 29 corporate venture capital firms. What follows is a summary of my findings which, I hope, will be useful for startup founders looking to raise their next round of financing. This research was done based on publicly available information (primarily the CVC’s websites).

The top 10 CVCs out of the 29 corporate venture firms reviewed for this article are listed below.

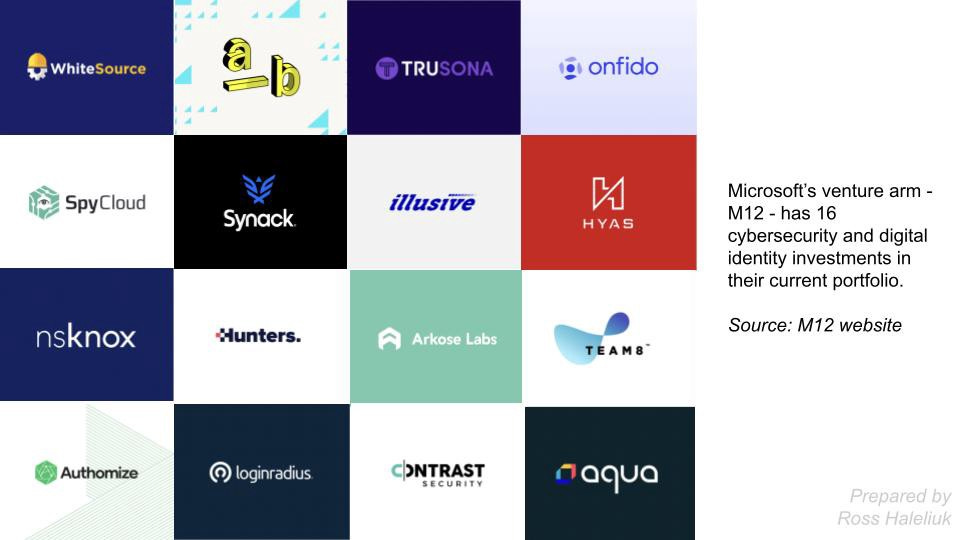

M12 Fund

Microsoft is one of the companies with the strong support of cybersecurity, which they accomplish through M12, their CVC arm. Four out of ten permanent investors at M12 have “security” as one of their areas of focus (two in Tel Aviv, one in London, and one in San Francisco). There are 16 security and identity startups in the current M12 portfolio of 90 companies: Aqua, Arkose Labs, At-Bay, Authomize, Contrast Security, Hunters, HYAS, Illusive, LoginRadius, nsKnox, Onfido, SpyCloud, Synack, Team8, Trusona, and WhiteSource.

Dell Technologies Capital

Dell Technologies Capital is a venture capital arm of Dell Technologies that invests in enterprise technologies and cloud infrastructure. Nine of 56 Dell Technologies Capital investments are into cybersecurity companies: Cymulate, Cequence Security, Calamu, Netskope, Lightspin, Appdome, Remediant, RiskLens, and Toka.

Citi Ventures

Citi Ventures is a venture arm of Citigroup that predominantly funds companies developing financial technology products and services. 15 of Citi’s 100 portfolio companies are related to security, identity, or anti-fraud solutions: Snyk, Socure, Silverfront, Styra, Tanium, Netskope, Pindrop, Trulioo, Tessian, Transmit Security, Feedzai, Illusive, Immersive Labs, BioCatch, and DB CyberTech.

Cisco Investments

Cisco Investments is a corporate venture capital arm of Cisco. Cisco Investments offers direct and fund of funds investments. There are currently 141 active investments in the Cisco Investments portfolio; 36 of them are investments in other venture funds and 18 of them are in cybersecurity: BehavioSec, Expel, Exabeam, Illusive, JupiterOne, Hunters, Rangeforce, Secure Code Warrior, Securiti, Styra, Valtix, Wabbi, ThreatQuotient, Panaseer, NS1, Corellium, SafeGuard Cyber, and Team8 (cybersecurity-focused fund).

Samsung NEXT

Samsung NEXT Ventures is the investment arm of Samsung NEXT, an innovation group within Samsung Electronics that invests in transformative early-stage startups. Ten of the 102 CVC’s active investments are into cybersecurity & identity management startups: Zimperium, Virtru, Stellar Cyber, Rezilion, INTEZER, HYPR, Guardio, Cylera, Cynerio, and UNUM ID.

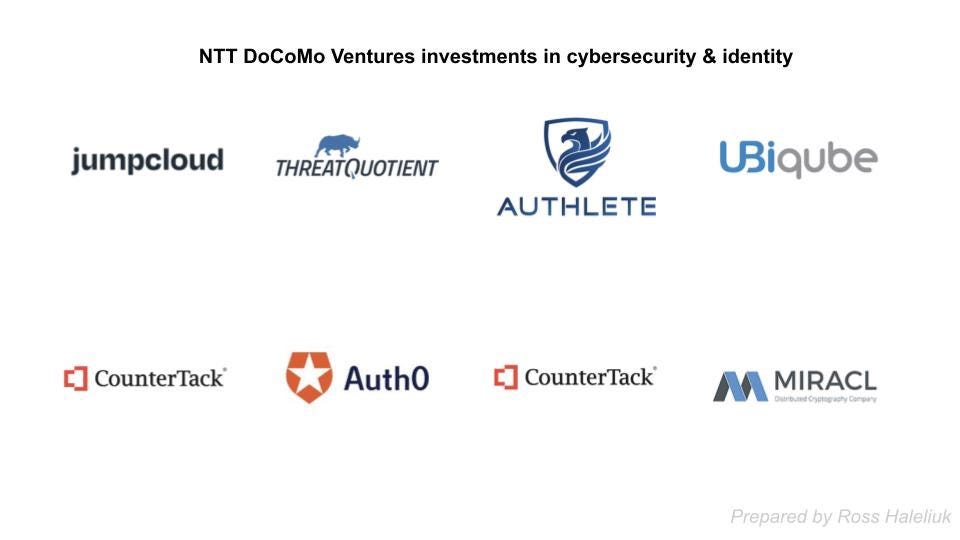

NTT DoCoMo Ventures

NTT DoCoMo Ventures is the venture arm of the NTT Group that has a diverse portfolio of 83 active startups across multiple industries and geographies.

NTT DoCoMo Ventures has invested in 8 cybersecurity and digital identity products: JumpCloud, ThreatQuotient, CounterTack, Authlete, MIRACL, Auth0, and UBiqube.

Intel Capital

Intel Capital is a division of Intel Corporation, set up to manage corporate venture capital, investment, and M&A. Currently, Intel Capital’s portfolio lists 229 portfolio companies; 13 of them are in the area of cybersecurity: SecureKey, Verica, Trinity Cyber, Vectra, Synack, Zumigo, SecurityScorecard, ZeroFox, Grip, Sam, Eclypsium, INTEZER, and Censys.

Salesforce Ventures

Salesforce Ventures is Salesforce’s investment arm focused on creating the world’s largest ecosystem of enterprise cloud companies. Out of 170 startups listed on the Salesforce website as a part of their current portfolio, 9 are cybersecurity startups: Upstream, PerimeterX, Onfido, Nymi, Elevate Security, Cerby, Bugcrowd, AttackIQ, and AppOmni.

Baidu Ventures

Baidu Ventures (BV) is a venture fund established by Baidu in 2017 that currently has about USD 500M assets under management (AUM) across 3 funds. BV has offices in Beijing and San Francisco and focuses exclusively on the broad applications of artificial intelligence (AI).

Of the 67 companies in the current BV portfolio, there are three that specialize in cybersecurity: Flow ++, YunDing / Loock, and Warp Future (all three are based in China). There does not appear to be any cybersecurity startups in BV’s international portfolio, but that is likely a coincidence as they invest in AI-powered companies globally, regardless of the industry focus.

CreditEase Fintech Investment Fund

CreditEase Fintech Investment Fund focuses on new growth drivers for the global economy and invests in high-growth, high-value innovative enterprises. There are currently 56 active investments in their portfolio, the majority of which are in fintech. Two of them are adjacent to cybersecurity — Onfido, an identity verification startup that has also received funds from Microsoft’s M12 & Salesforce Ventures, and in Biocatch, a behavioral biometrics verification platform.

Other Corporate Venture Capital firms

GV

GV, formerly known as Google Ventures, is the venture capital arm of Alphabet Inc. that operates independently from Google and makes financially driven investment decisions. There are 296 active portfolio companies in GV’s portfolio; of these 10 are cybersecurity startups: Acalvio, Anomali, Censys, CyberGRX, Lacework, Obsidian, Pensando, SecurityScorecard, Snyk, and Synack.

Qualcomm Ventures

Qualcomm Ventures is the venture capital arm of Qualcomm, a tech giant that creates semiconductors, software, and services related to wireless technology.

Three of 126 active companies in Qualcomm Ventures’ current portfolio are in cybersecurity: Eques (smart home security), Lookout (mobile security), and Team 8 (Israeli “cybersecurity foundry”).

One of the 140 companies in the Korean Kakao Ventures’ portfolio (Perseus) is in cybersecurity.

SBI Investments

Three of the 209 companies in the current SBI Investments’ portfolio are cybersecurity companies (Eaglys, Ierae Security, and Closip). While all three are based in Japan, the fund does invest internationally.

GE Ventures

GE Ventures (the venture capital subsidiary of General Electric) does not list their portfolio publicly. However, according to Wikipedia, GE does have an interest in cybersecurity and has previously invested in Mocana (acquired by DigiCert in January 2022), among other cybersecurity companies.

Z Capital

In 2021, LINE Ventures (corporate venture arm of Line Corporation, the creator of the mobile messaging app LINE) merged with YJ Capital (corporate venture capital arm of Yahoo Japan), launching a $271M Z Capital fund. One of the fund’s 156 investment bets is the Japanese Ierae Security, a startup that has also received funding from SBI Investment discussed before.

KB Investment

KB Investment is a subsidiary of KB Financial Group that manages venture capital and private equity funds. It has invested into the ArkData (a business continuity solution), Autocrypt (autonomous driving security), and Astron Security (cloud infrastructure security) among its 216 active investments.

Bertelsmann Investments

Bertelsmann Investments (BI), Bertelsmann’s global venture capital arm, encompasses four funds: Bertelsmann Asia Investments (BAI), Bertelsmann India Investments (BII), Bertelsmann Brazil Investments (BBI), and Bertelsmann Digital Media Investments (BDMI, investing in the United States and Europe); as well as fund-of-fund investments in Southeast Asia and Africa, and funds with a focus on new technologies (source: BI). Bertelsmann India Investments (BII) has 14 companies in their portfolio, representing a broad range of industries including fintech, edtech, and agritech. There are no cybersecurity companies in BII’s current portfolio. Bertelsmann Brazil Investments (BBI) has invested in several companies in the educational sector and digital media; it is not clear if there are any cybersecurity companies in their portfolio. Bertelsmann Asia Investments (BAI) does not list the most up-to-date investment portfolio (their portfolio page seems to be down).

Bertelsmann Digital Media Investments (BDMI) invests in four main areas — media, brands, enterprise SaaS, and fintech across the United States and Europe. Their main fund has 17 portfolio companies, none of which are in cybersecurity. Current BDMI Seed Investments include 44 startups, with no investments in cybersecurity. One of their portfolio companies, Sensity, focuses on Identity Verification & KYC.

Mitsubishi UFJ Capital

Mitsubishi UFJ Capital is the venture capital arm of the Mitsubishi UFJ Financial Group. There are 246 startups the CVC has invested in; of these only one (Ierae Security) is in cybersecurity and one (Trustdock) is in the KYC (identity verification) space.

Amazon’s Alexa Fund

Amazon’s Alexa Fund ($200 million AUM) has been investing in startups that are innovating in AI, voice technology, frontier tech, robotics, and more. Surprisingly, there are no cybersecurity companies in their portfolio. More in line with Amazon’s focus, the fund has invested in ecobee and Scout, hardware startups working in the area of smart home security.

Other

There are no cybersecurity companies in the Legend Capital, GREE Ventures, Monex Ventures, Shell Ventures, and Fosun RZ Capital portfolios, based on the publicly available information. Novartis Venture Funds, Alexandria Venture Investments, Johnson & Johnson Innovation, and Novo Ventures are the corporate venture funds active in life sciences (no interest in cybersecurity).

General Observations

Some CVCs such as M12, NTT DoCoMo Ventures, and Dell Technologies Capital choose to specialize in cybersecurity and have developed both internal expertise and industry connections to add a lot of value for startups looking to get more than growth capital.

Some startups received funding from multiple corporate venture funds. For example, Onfido received funding from as many as three different CVCs (M12, Salesforce Ventures, and CreditEase Fintech Investment Fund). While it is not known how the technology is being used by each of the parent companies of these CVCs, it is clear that raising funds from relevant corporate venture funds can be a great strategy to increase product adoption and form mutually beneficial partnerships.

It appears that in most cases, CVCs tend to invest in areas that overlap with the focus on their parent company. For example, startups in the identity verification space are likely to find potential investors in the financial services & fintech space, as they are likely to benefit from these technologies. However, this is not the rule and some CVCs make financially-motivated investments.

Closing Notes

The list of corporate venture capital firms was computed based on the open research and resources such as CB Insights and AngelList. The selection does not necessarily reflect the top firms by AUM or any other criteria.

This article focused on the number of companies financed by selected CVCs, not the total amount of money invested in this field. It is possible that corporate venture funds that have invested in more companies, have committed less capital in total.

The summary of all corporate venture funds analyzed is provided below.